Depreciation recapture calculator rental property

Luckily you can avoid depreciation recapture tax on a rental property. How do I calculate depreciation recapture.

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Rent

Typically the county rejects.

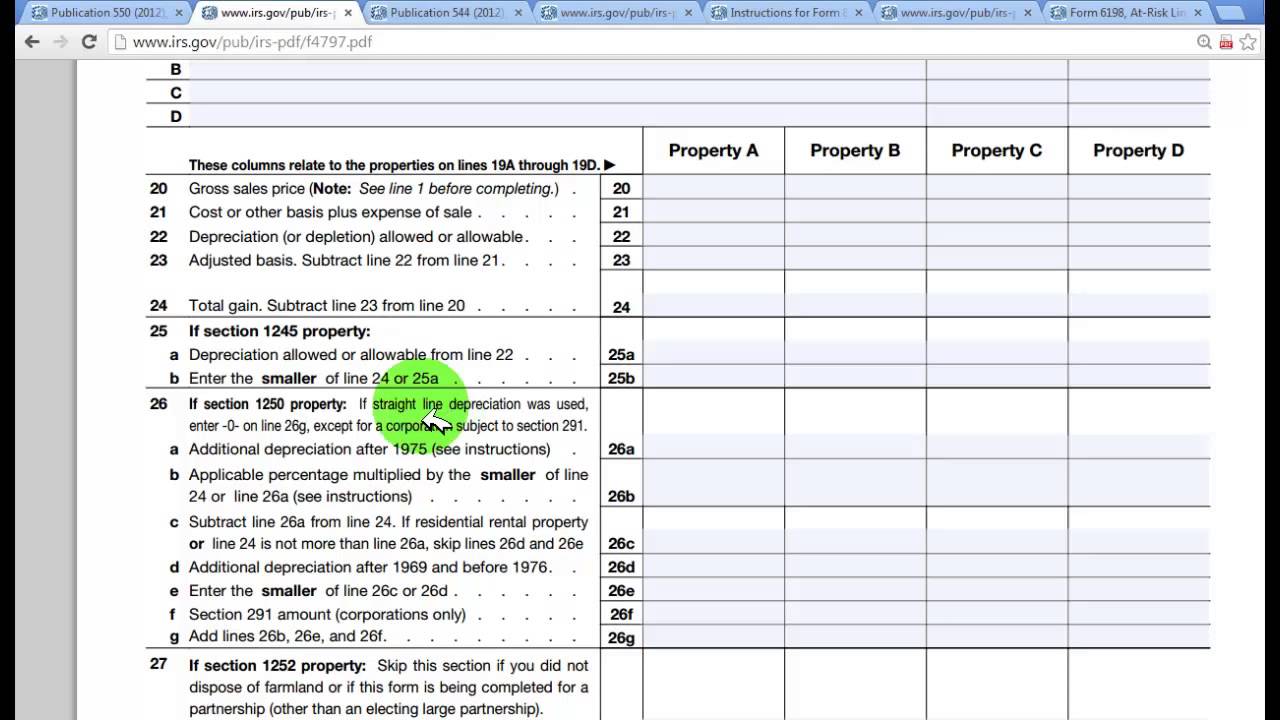

. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills. Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. 5 Okay subtract the total depreciation expense calculated in Step 2 from the total gain to compute your capital gain as opposed to your depreciation recapture gain.

Though a rental property depreciation calculator is a helpful tool for investors there. In Georgia a homeowner typically has 120 days to appeal an assessment of your property Ailion says. It is designed to give you property tax estimates for.

We look for the most similar properties in your area and estimate the rent for your property based. Depreciation recapture is taxed at an investors ordinary income tax rate up to a maximum of 25. Even with these guidelines rental property depreciation can be difficult for investors that need to depreciate partial years of rental property ownership.

Calculate adjusted cost basis. Estimate your Louisiana Property Taxes. How to Calculate Depreciation Recapture.

100000 cost basis x 1970 1970. In this step you take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life. How do you avoid depreciation recapture on rental property.

Remaining profits from the sale of a rental property are taxed at the capital gains tax rate. The IRS requires that the depreciation for the first year be prorated for the number of months the property is in use. 1 The straight line depreciation formula for a partial first.

Depreciation recapture is assessed when the sale. The county can accept reject or propose a different value. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

Our database will provide data for that property and properties like it. Rental property is subjected to depreciation and the rental. Use this New Orleans property tax calculator to estimate your annual property tax payment.

It allows them to deduct the cost of their property along with. September 10 2022 504-367. Purchase price land value improvements closing costs 200000 - 40000 50000 10000 220000.

Use this Louisiana property tax calculator to estimate your annual property tax payment. One of the best methods is to use a 1031 exchange. The calculator will automatically apply local tax rates when.

The calculation involves the following steps. Say that your rental property has only. Divide Cost by Lifespan of Property.

Your initial cost basis would look like this. Property 3 days ago 5 Okay subtract the total depreciation expense calculated in Step 2 from the total gain to compute. Purchase price land value improvements closing costs 200000 - 40000 50000 10000.

Tax Rate On Real Estate Capital Gains Tax Impacts On The Disposition Of A Rental Property Held By An Individual

Rental Property Depreciation Rules Schedule Recapture

Understanding Rental Property Depreciation 2022 Bungalow

Can I Not Claim Depreciation On My Rental Property

Pin On Real Estate Info

8 Powerful Real Estate Investment Calculators A Full Review

Pin On Airbnb

Tax Implications Of Canadian Investment In A Florida Rental Property

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties In 2021 Rental Property Management Rental Property Rental Income

How To Use Rental Property Depreciation To Your Advantage

Short Term 2022 Rental Property Cash Flow Calculator

Tax Rate On Real Estate Capital Gains Tax Impacts On The Disposition Of A Rental Property Held By An Individual

Tax Treatment Of Sale Of Rental Property Youtube

Capital Gains Recapture On Disposition Of A Rental Property Youtube

Tax Benefits Of Accelerated Depreciation On Rental Property

Form 4562 Rental Property Depreciation And Amortization

How To Use Rental Property Depreciation To Your Advantage